In today’s digital age, internet services have become an integral part of our daily lives, transforming how we connect and engage with the world. This article is being written to raise awareness among general internet users about the importance of selecting the service provider, requesting internet invoices and receipts, verifying taxes on these invoices, and making the correct payments. By adopting these practices, we protect ourselves from potential exploitation and support the government in collecting the rightful amount of taxes. Additionally, the users need to verify the legitimacy of service providers to deter illegal operators.

Understanding the Importance of Internet Invoices and Receipts:

Invoices and receipts issued by Internet service providers serve as crucial documents for consumers and the government. Users can track their transactions by requesting and maintaining these records and ensuring they are charged fairly. Moreover, these documents are valuable during the users’ annual income tax return filing and can help avoid being overcharged.

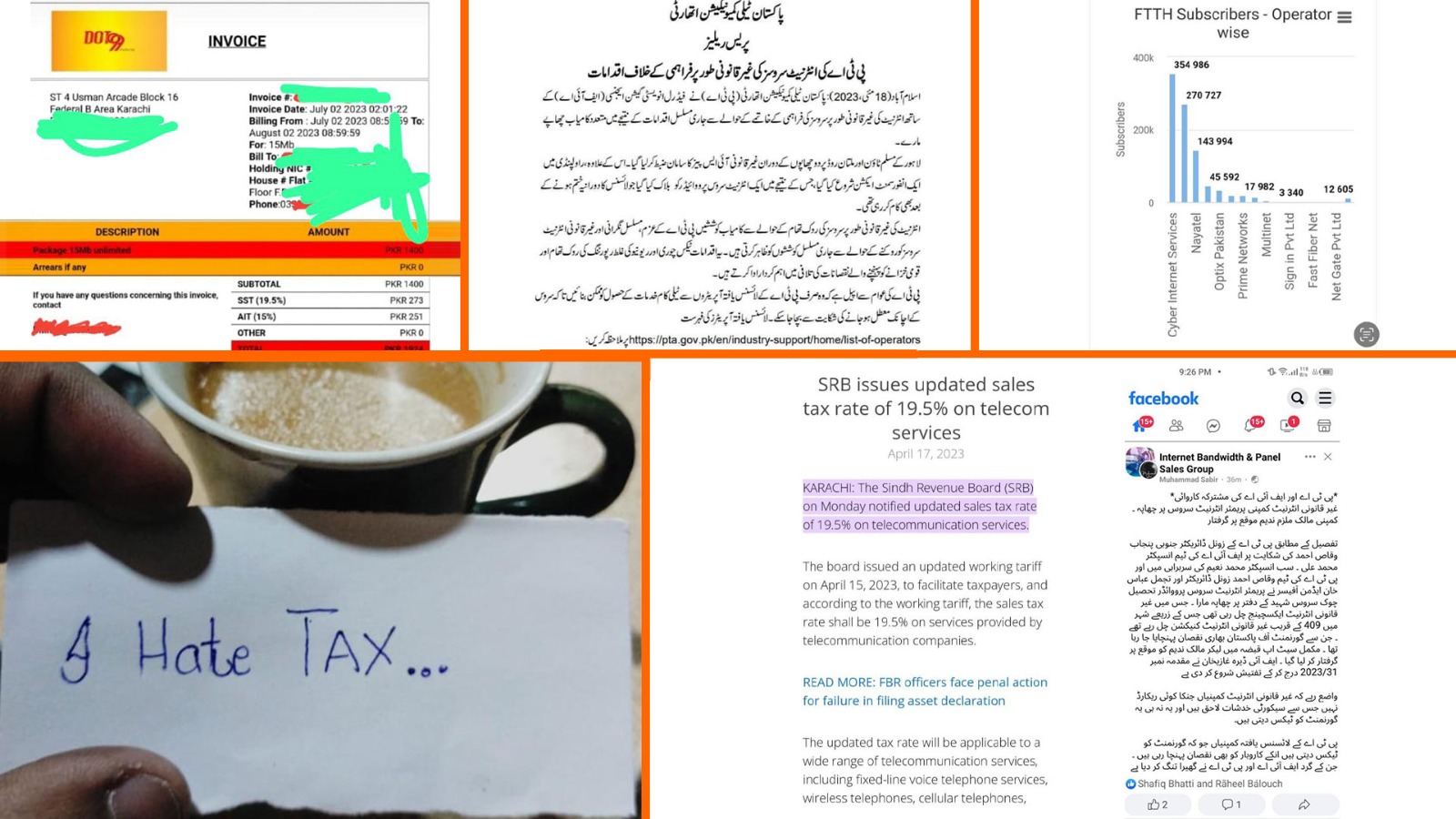

Verifying Taxes on Internet Invoices:

It is essential for internet users to verify the taxes mentioned on their invoices to ensure accuracy, as the provincial government charges 19.5% and the federal government charges 15% on internet services. Many service providers may attempt to exploit customers by generating invoices with lower values, but charging higher amounts, which gives loss not just to the individual user, but also to the government revenue due to under-invoicing. Users can safeguard themselves from such malpractices by carefully scrutinizing the tax components. Additionally, by ensuring the correct amount of taxes is paid, we contribute to the country’s exchequer.

Making the Correct Payment:

Making the right payment for internet services is about the amount and ensuring compliance with tax regulations. Users can confidently make the correct payment by understanding the tax calculation and verifying its alignment with the invoice details. Customers should promptly contact their service providers for clarification and rectification in case of any confusion or discrepancies. Always ask for the invoices and receipts from your service provider.

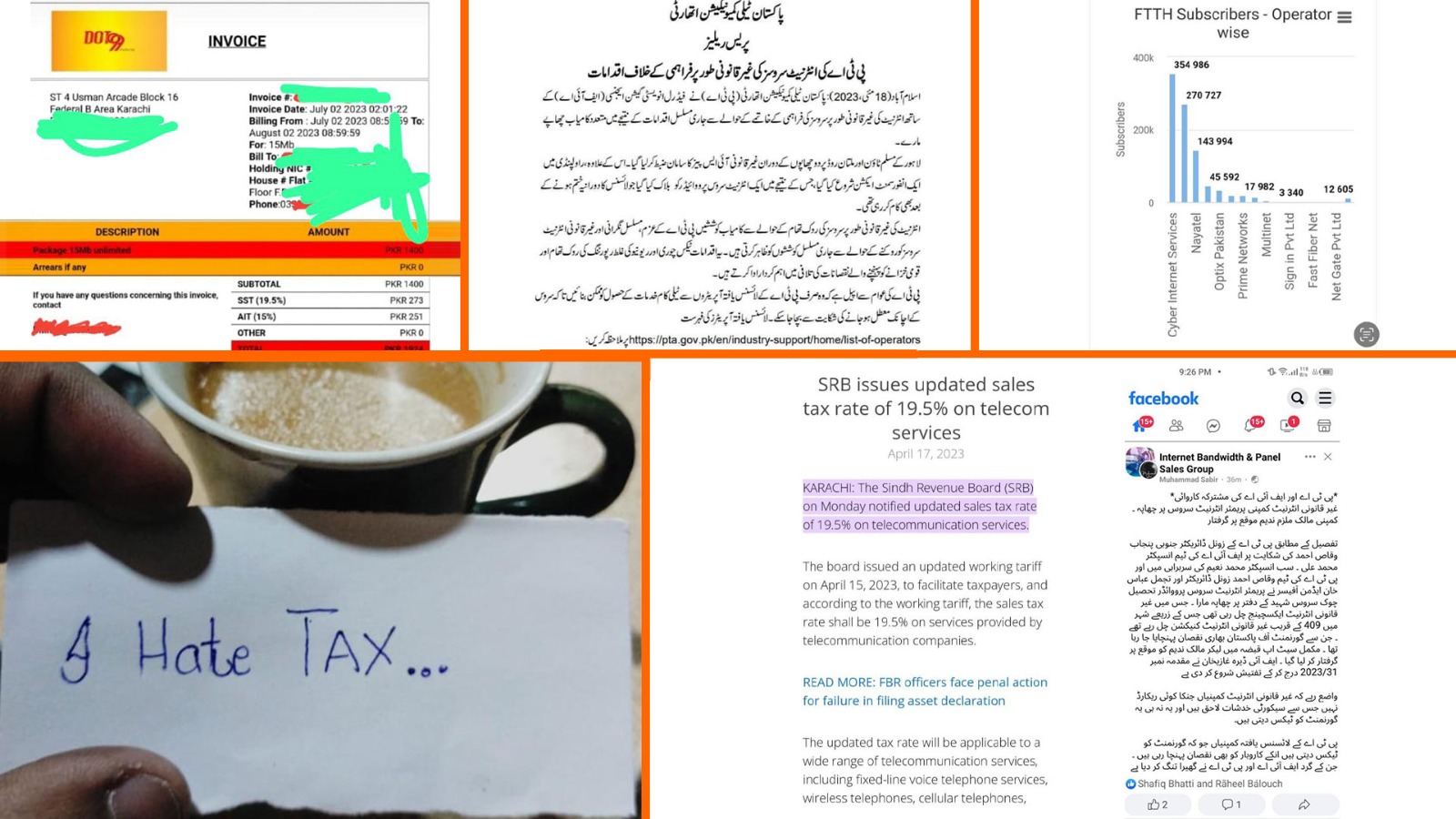

Checking Service Provider Legitimacy with the Regulatory Authority:

Pakistan has witnessed an increasing number of illegal internet service providers resulting in financial losses for the government. To protect ourselves and support legal operators, verifying the legitimacy of service providers on the PTA website (list of operators) is essential. By doing so, we can make informed choices and contribute to eliminating unscrupulous service providers. PTA has conducted successful raids in different cities to eliminate illegal service providers in collaboration with FIA

Concerns on Social Media and other Platforms:

On social media platforms like Facebook (for e.g, Pakistan Internet Service Providers Support, facebook Support Group, and WhatsApp groups, discussions about price variations in the name of taxes are prevalent. While some variations may be legitimate due to regional differences or specific tax policies, it is crucial to be cautious of potential scams. By promoting awareness and knowledge about tax regulations, we can empower ourselves and others to identify and report suspicious activities.

Conclusion:

As responsible internet users in Pakistan, it is our duty to be vigilant and proactive in ensuring transparent internet services and tax compliance. By requesting internet invoices and receipts, verifying taxes, and making the correct payments, we contribute to the government’s revenue collection efforts and the overall development of our nation. Additionally, by checking the legitimacy of service providers on the PTA website, we foster a trustworthy digital environment for everyone. Let us work together to protect our interests, support legitimate operators, and uphold the integrity of our nation’s digital landscape.

Input & Facts Check by Abdul Aleem Sheikh, Certified Information Systems Auditor® (CISA®)